Top Reasons Life Insurance Won’t Pay Out in Canada

Worried about the reasons life insurance won't pay out? Rest easy - this is extremely rare. Here's some of the reasons (and why you don't need to worry!).

Life insurance payout in Canada: what is it?

The life insurance payout (or "death benefit") is a tax-free lump sum paid to your beneficiaries if you pass while your life insurance policy in Canada is active.

Your beneficiaries can use these funds however they see fit, including:

- Paying for final expenses

- Paying off a mortgage or other debts

- Replacing lost income

- Providing for your kids (i.e. childcare costs or post-secondary education)

- Day-to-day expenses to maintain your family's standard of living

Reasons life insurance won't pay out in Canada

First off, in Canada, only about 4% of life insurance claims are denied, meaning over 96% of eligible claims are paid out when policies are active and applications are accurate.

Common reasons a payout could be declined include providing inaccurate information on your application, a policy lapse due to a missed payment, or the cause of death being excluded in your policy.

Main reasons life insurance claims are denied in Canada:

1. Inaccurate information on your application

Your life insurance payout may be denied if you misrepresent information on your application, such as your medical history.

It is considered intentional misrepresentation if you withhold information or lie to get a more affordable premium during your application process. If you claim not to be a smoker, for example, but the life insurance medical exam during your application reveals years of smoking, that's misrepresentation.

There are a few outcomes if it's revealed you intentionally lied. The best-case scenario is paying higher life insurance rates if this misrepresentation is revealed before you're approved. Otherwise, companies may deny coverage.

Made a mistake on your application? We suggest contacting a customer advisor immediately. To fix changes, your insurance provider might ask for documentation and proof to ensure you're not scamming them.

2. Policy lapsed due to missed payment

You need to make timely payments on life insurance to keep it active or your policy may lapse. If something happens to you and you have missed payments, the insurer can deny your claim.

Policies often lapse because life insurance premiums are too expensive for the policyholder to keep up with. This is especially true for permanent life insurance policies, which can cost up to seven and a half times more than a similar term life insurance policy.

3. Policyholder passes away during contestability period

A contestability period is a set timeframe, usually one to two years after your policy is put into place. If you pass during your policy's contestability period, the insurance company might reevaluate your policy.

This ensures you don't misrepresent yourself during the application process and protects insurance companies from fraud.

4. Death by suicide in the first two years

Most life insurance policies include a suicide clause; if you die by suicide within the first two years of your policy being in place, it won't pay out your death benefit. This is the norm for life insurance policies in Canada, including with PolicyMe.

A life insurance policy does cover death by suicide if it happens after you have held the policy for over two years.

5. Your beneficiaries aren't aware the policy exists

Sometimes beneficiaries don't know their loved ones have a life insurance policy. When that happens, the person you named your beneficiary won't claim that benefit. It’s more common than you might think.

We always recommend being transparent with your loved ones if you name them your beneficiary. It saves them the hassle and ensures they're financially protected as you intended!

If a loved one forgets to let you know you're the beneficiary, you can also search for a lost policy using OLHI search tool.

6. You didn't update your beneficiaries or name a secondary beneficiary

Your insurance won't always be passed down to your family if you have forgotten to name your beneficiaries for your life insurance payout. Instead, it will be used to pay for your estate first.

If any remaining insurance money is left, the rest will go to your family; usually, it's not much.

To avoid this, it's a best practice to name primary and secondary beneficiaries. That way, you can be sure the money you're taking out to protect your loved ones does just that.

7. Your beneficiary passes before you

The payout will go to your estate if your beneficiary passes away before you and there’s no alternate or contingent beneficiary listed. This can delay access to the funds and potentially reduce the amount received due to estate taxes or legal fees.

To avoid this, consider naming:

- Multiple beneficiaries, who can share the payout according to percentages you choose.

- A contingent (or alternate) beneficiary, who will receive the benefit if your primary beneficiary passes away before you do.

Designating both primary and backup beneficiaries helps ensure your life insurance proceeds go directly to the people you intend to support without legal complications or delays.

8. Cause of death is excluded in your policy

Life insurance companies usually provide a list of things they won't cover called the "exclusion clause." Read your policy carefully to see what exclusions may be in your agreement. These might include:

Common life insurance clauses you should know

Here are a few lesser-known life insurance clauses that can affect your coverage or how (and when) your payout is made.

Should you be worried your life insurance claim won't get paid out?

Short answer, you likely don’t need to be worried your life insurance claim won’t get paid out. If you're honest on your application and timely with your premium payments, you'll face no real issues when it comes time to make a claim.

There are two main worries that people tend to have about the payout:

- The claim will be denied

- The insurance company will go under and be unable to payout.

Both of these scenarios are unlikely. Here's why:

There are also organizations like Assuris, a Canadian non-profit that protects Canadian life insurance providers if their company fails.

How to prevent your claim from being denied

Here are the top things you can do to prevent your life insurance payout claim from being denied.

1. Be honest on your application

If you’re honest with your life insurance provider throughout the application process, it makes it near impossible for them to deny your claim.

The majority (of a tiny amount) of declines happen due to intentional misrepresentation. Misrepresentation won’t be an issue if you are as honest as possible about your medical condition from the start.

There is the option to get no medical life insurance, which requires no medical exam or questions. But no medical insurers charge higher rates since they can't properly assess your risk level based on your health condition.

2. Understand your policy's exclusions

Every life insurance policy has exclusions. For the most part, it's just death by suicide within the first two years. But life insurance is a pretty personal product, so exclusions can vary for each company and policyholder.

Make sure you fully know the exclusions on your policy to avoid this, not just the exclusions you've heard of. Each policy is unique. For example, if you have a high-risk hobby like professional skydiving, your policy may have an exclusion for death in a skydiving accident.

When you know what your exclusions are, you know what actions will prevent you from receiving a claim. You'll also know for sure if you're eligible for the death benefit, minimizing the chances of disappointment.

3. Keep up with your payments

When you stay up to date on payments, you don’t need to worry about your policy lapsing when you need it most.

If you miss one payment by mistake, don’t panic! This doesn’t mean your insurance policy is entirely void and you need to restart the application process.

Most life insurance companies have a 30 day grace period. If you miss a payment, the company will let you know and allow you to make it up in that window. You can even opt for a double payment at your next premium due date.

In the case you go beyond the 30 day mark and don’t make the next payment, you no longer have coverage.

Can I pick up my life insurance where I left off? If your policy hasn’t been inactive for too long, you may be able to reinstate it by contacting your insurer. They will ask a few questions to confirm your health is relatively unchanged. Once you pay your premiums for missed months, your coverage can be reinstated.

How do my beneficiaries make a claim?

Here's what you need to do if you are the beneficiary of a death benefit and the policyholder passes away during the term.

1. The first thing you want to do is contact your life insurance provider if somebody passes away and you were a beneficiary of their life insurance.

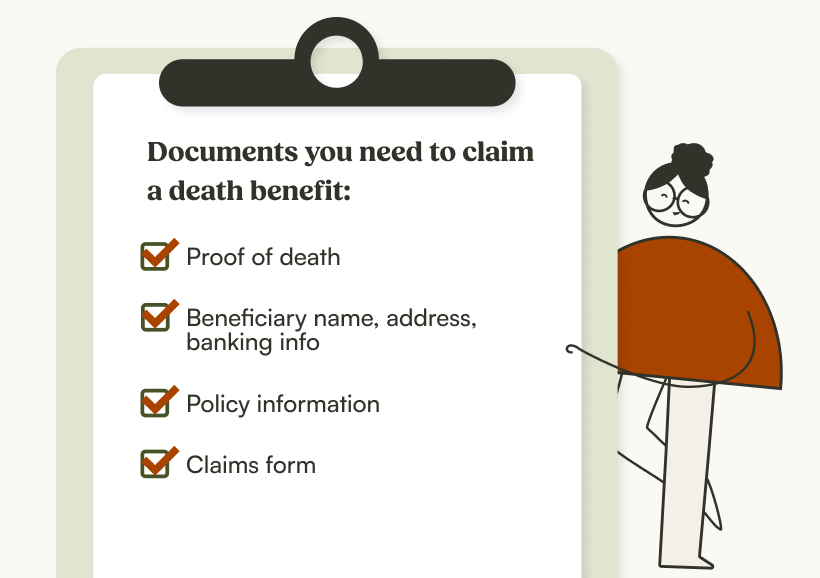

2. From there, they will give you a list of documents you need and forms to fill out. Here are some of the documents and forms you can expect to need or to fill out:

3. Once you gather all this information and share it with the life insurance provider, they will do some policy checks. This includes things like checking if the policy is still active before putting the claim through.

4. From there, your only job is to wait for the claim to be processed. You can answer any questions the life insurance provider may have along the way.

There is no hard and fast rule on how long processing a claim takes. Life insurance companies tend to try to pay out as soon as possible. You can expect it anywhere between a few days to upwards of 60 days, depending on your situation.

With PolicyMe, making a claim is simple. You'll get a dedicated adjudicator who will review your claim and help you navigate the process, so you can focus on being with your family.

Who can make a life insurance claim?

In most cases, your primary or secondary named beneficiaries—the person or people listed in the policy—can make a life insurance claim after you pass away. Beneficiaries are often spouses, children, or other close family members, but they can be anyone you chose.

If no beneficiary is named (or if all named beneficiaries have passed away), the claim will typically go through your estate, and the executor of your estate will be responsible for filing the claim.

To ensure a smooth and timely payout, it's important to keep your beneficiary information up to date and to let your beneficiaries know that they are listed on your policy.

What do I do if my life insurance claim is denied?

If you are denied, you should be provided with a very clear reason. The insurance company needs to share the exact reason why they deny coverage claims.

Here’s what you can do:

- Contact the insurer and get more information: Ask your insurer for an in-depth explanation of why you were denied, and document your conversations. Insurance policies are legal contracts, and the rights and responsibilities of the insurers and the policyholder are always written down. So if you were denied, there should be a clear explanation.

- Once you know the reason you were denied, you can contest it: Appeal the insurance company’s decision in writing. All licensed insurers have a designated person/department assigned to dispute resolution, usually the Complaints Liaison Officer.

- When making a complaint, make sure that it is: clear, informative, backed up by documented evidence, and timely. This process can take time, so give your CLO time to investigate and formulate an answer.

- Contact law firms specializing in financial disputes: They will put together a case as to why your claim shouldn’t be denied. Depending on their rates, it may be worth it if they are confident they can benefit you.

- Contact the government: As a final resort, you can also contact a federal institute like the Financial Consumer Agency of Canada if your claim is unresolved.

Bottom line: Your life insurance claim is very likely to pay out!

- The main reasons that your life insurance might not pay out are tied to dishonest answers to the life insurance application, exclusions on your policy, or the death occurring outside of the payment terms.

- Most life insurance companies hold billions of dollars in assets, meaning they already have the money in the bank to pay the death benefit.

- Be sure to read your policy carefully so you understand exactly what’s covered, and what’s not!

FAQs: What disqualifies a life insurance payout?

Jaya is a researcher and writer with 3 years of experience in insurance and finance. She writes in-depth content that bridges technical expertise with accessible insights. Her work spans topics such as life insurance, health and dental coverage, car insurance, and financial literacy, helping Canadians make informed decisions about their financial protection. With a background in market research and editorial strategy, she collaborates closely with subject matter experts to ensure accuracy, clarity, and value in every piece.

Jaya is a researcher and writer with 3 years of experience in insurance and finance. She writes in-depth content that bridges technical expertise with accessible insights. Her work spans topics such as life insurance, health and dental coverage, car insurance, and financial literacy, helping Canadians make informed decisions about their financial protection. With a background in market research and editorial strategy, she collaborates closely with subject matter experts to ensure accuracy, clarity, and value in every piece.