What is Whole Life Insurance?

This page provides general information about whole life insurance. All information provided here is for educational purposes only and should not be considered financial or legal advice. While PolicyMe does not offer whole life insurance plans, we offer permanent alternatives like Term to 100. If you would like to learn more about whole life or any other options for you, please feel free to reach out to an advisor.

What is whole life insurance?

Whole life insurance is a type of life insurance that is permanent, meaning that it provides coverage over your entire life vs. term life insurance, which covers you for a specific period (usually 20-30 years). A whole life insurance policy is a lifelong policy that stays active as long as you pay your premiums.

Whole life insurance, explained

There’s a lot to know about whole life insurance. But for starters, here are five key things you should know about whole life insurance:

If you're searching for whole life insurance, you’re probably in your 30s or 40s, and a financial advisor recently brought it up. Whole life policies are often pitched as a smart move either for yourself or as a “gift” policy for your kids.

There are typically two main selling points for whole life insurance:

- It’s lifelong insurance coverage

- It also acts as a vehicle for savings/investments

But here’s the truth: Whole life insurance does a pretty poor job at both. When you stack its average returns against something like the S&P 500, it doesn’t even come close. And while it is technically life insurance, the way the premiums are structured means you’re prepaying now for the cost of insuring yourself well into your 80s and beyond.

The end result? You end up paying significantly more for coverage than you would with a term policy, which leads a lot of people to cancel their plans before they even get close to a payout.

The premiums for whole life insurance are fixed—but they’re usually significantly higher than those for term life insurance since whole life policies are lifelong and have an investment component.

If you cancel a whole life insurance policy, your family or loved ones will no longer receive a payout after your death—but you can still withdraw the cash value, minus any fees and penalties. This is called the cash surrender value.

While whole life insurance has its uses—usually for high-net-worth estate planning—it’s rarely the right choice for the average Canadian family. Whole life insurance tends to be an expensive solution to problems that could be solved more efficiently with a term life insurance policy and independent investing.

Really want a permanent policy? Learn more about Term to 100 insurance

Pros and cons of whole life insurance

It’s no secret that we aren’t big fans of permanent life insurance—but you should carefully consider the benefits and drawbacks of whole life policies before deciding if one is right for you.

How do whole life insurance premiums work?

Whole life insurance provides lifelong coverage (i.e., a guaranteed death benefit) as long as you continue to pay the premiums.

- Premiums are fixed. This means that you’ll pay the same monthly rate over the course of the policy. As long as you pay premiums on time, your coverage remains active.

- Premiums are split. Part of the life insurance cost goes towards the coverage and fees, while the other part (the “excess premiums”) builds up the policy’s cash value.

- Excess premiums are invested. Your insurance company will invest the cash, generating interest for your policy’s cash surrender value.

- More cash value means growth. The greater the cash value component, the more interest is accrued, and the greater the policy value.

Is whole life insurance a good investment?

The short answer: no.

Here’s the long answer:

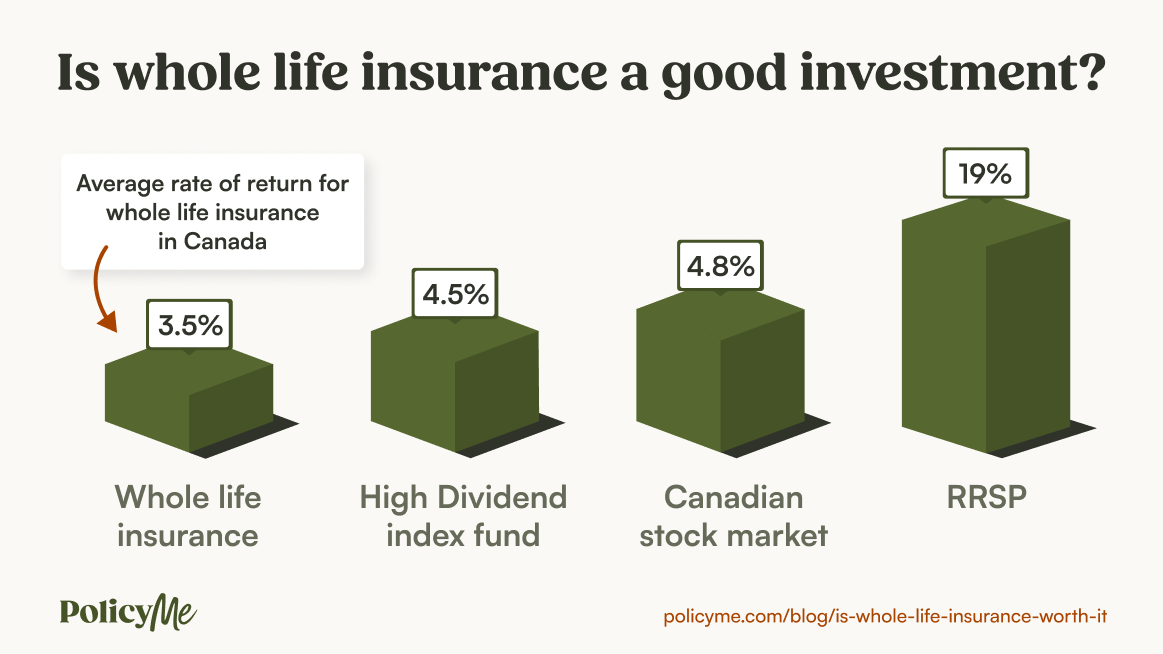

One of the biggest selling points of whole life insurance is that it has an investment component through the cash value. That rate of return is no greater than 4%—the average is 1 to 3.5%, as reported by The Insurance Pro.

The S&P 500, in contrast, has historically offered an average annual return of 10.26% since 1957, including dividends. Even when adjusted for inflation, that's an average of 6.6% per year. RRSPs often mirror these returns, offering potential growth that significantly outpaces whole life policies.

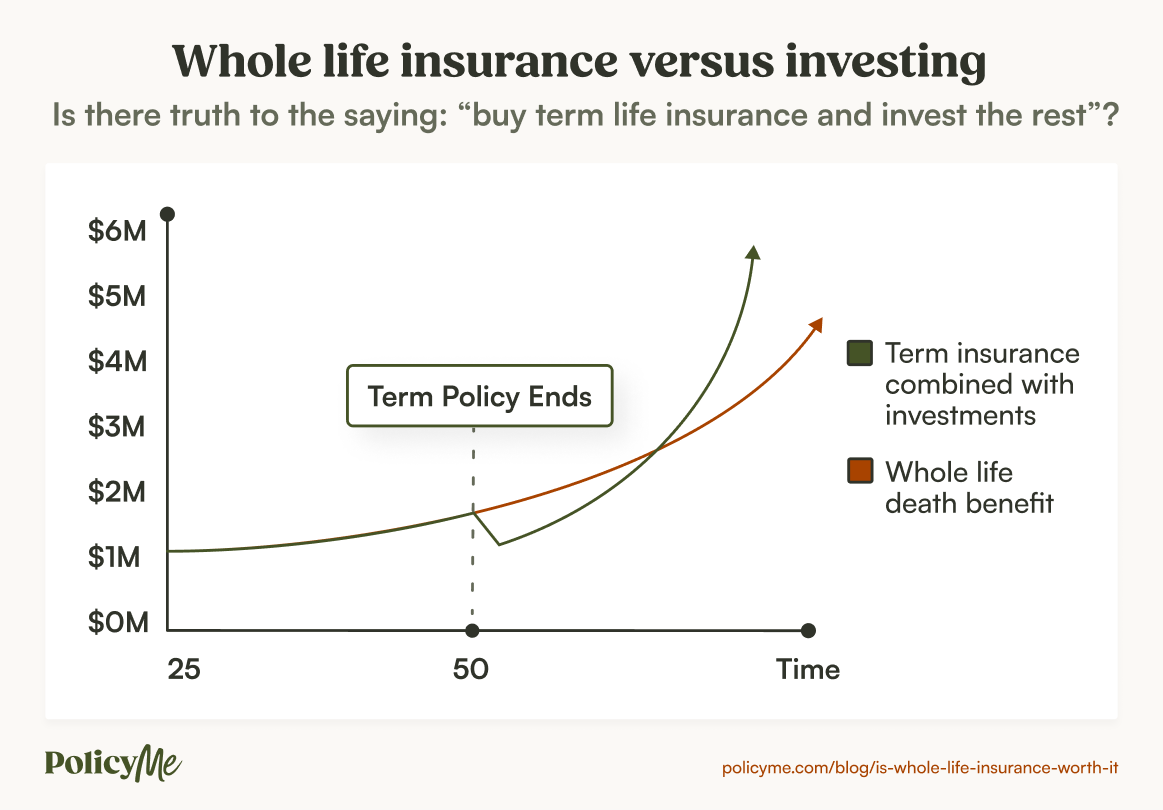

Purchasing a term life policy that covers your financial obligations during the time they exist will not only be a cheaper choice, but also leaves you with extra cash to put in other investment accounts.

Whole life fine print and hidden risks

On top of the investment component, whole life insurance actually has a few contingencies that you may not be aware of:

The idea that whole life insurance is a good investment is more of an urban myth than rooted in fact.

“I don’t always recommend life insurance as an investment. But for a higher-net-worth client, we will often use life insurance as a savings mechanism for funds they wouldn’t otherwise use while living.” —Susan Cruikshank, Senior Tax Manager at BDO Canada LLP

Cashing out a whole life insurance policy

You can tap into the cash value of your whole life insurance policy, but withdrawals are taxable. And while the idea of accessing that money may sound appealing, you’ll never be able to withdraw anywhere close to the amount you’ve paid in.

If you cancel or surrender your policy, you’ll be entitled to get the policy’s cash surrender value, but your beneficiaries and loved ones will not receive the death benefit when you pass away.

If you pass away while your whole life coverage is active, your beneficiaries will receive a guaranteed death benefit. The policy’s cash value (or what remains of it) goes to the life insurance company.

For most people, the wiser path is getting a term policy and investing the rest—that way, they get full access to the entire balance if they need to. —Erik Heidebreicht, Life Insurance Advisor

Is the cash surrender value a good investment?

The cash surrender value can be a good investment, but the limitations of whole life insurance policies create some challenges. There are four main reasons why the cash surrender value isn’t the straightforward investment some might think:

Other investment options

It’s probably a better idea to invest your money in other avenues than spend it on a permanent life insurance policy. Permanent life insurance policies provide a guaranteed rate of return, but the high cost of paying into the policy throughout your life makes it less rewarding than other types of investments.

If investing is a priority for you, we’d suggest purchasing a term life insurance policy that covers your mortgage and the financial needs of any dependents or loved ones. Then, invest the money you save on premiums elsewhere—where you’ll probably get higher returns.

“For the average Canadian, TFSAs and RRSPs are the better option for long-term financial health. You get similar tax benefits without underlying fees, and there’s more flexibility in how the funds are invested and withdrawn.” —Susan Cruikshank, Senior Tax Manager at BDO Canada LLP

Here’s how the investment potential of permanent life insurance compares with the combination of term insurance + investing your savings:

Who is whole life insurance good for?

There are some circumstances where whole life coverage might be worthwhile:

- People who want hands-off investing with a guaranteed minimum rate of growth.

- High earners who have maxed out other tax-deferred investment options

In both cases, buying life insurance is less about financial protection and more about putting funds away for tax-deferred growth.

Alternatives to whole life insurance (you have options!)

There are four other main types of life insurance policies available for Canadians:

Take note: It’s rare for a life insurance advisor to recommend mortgage life insurance. Premiums can cost up to 45 per cent more than a term policy and the payout mostly benefits the mortgage lender, not your loved ones.

Whole life vs. universal life vs. term life insurance comparison

While all life insurance offers a tax-free death benefit, each has unique features:

- Permanent life insurance policies have guaranteed premiums and a cash value component

- Universal life insurance is known for its flexibility

- Term life insurance has some of the lowest premiums in the industry, get a quote now to find out

.png)

Whole life insurance is best for:

- High earners looking to expand their tax-deferred savings options beyond TFSAs and RRSPs

- Individuals seeking a hands-off investment vehicle with consistent accrued interest

- Those interested in leveraging their policy’s cash value for a policy loan or line of credit

Universal life insurance is best for:

- High earners who want to combine permanent coverage with investments

- People who are willing to put time into coordinating their investment portfolio

- Those who want flexibility with premiums and the death benefit amount

Term life insurance best for:

- Individuals who need to provide financial security to their dependents over a set period of time (.e.g., the duration of your mortgage or until your kids are independent)

- People who want affordable life insurance coverage—term policies cost up to 7.5x less than permanent life insurance products

Read more: Term vs. whole life insurance

Still adamant about a whole life policy? We get it—and we want you to make the best decision for you and your loved ones. Before you sign anything, be sure you understand what you’re signing up for. Insurance advisors Erik Heidebrecht and Tobin Tuff take you through the fundamentals of whole life insurance in this video:

The bottom line: Is whole life insurance worth it?

Whether whole life insurance is worth it or not depends on your individual situation and financial goals.

Whole life policies tend to be more expensive than term life insurance due to the cash value component and lifetime coverage. Plus, the returns on the cash value are often much less than what you could earn from other types of investments.

Some Canadians may get value from whole life insurance, but for many people (particularly young, healthy adults who are on a budget), other types of life insurance and investments might be a better fit.

FAQ: Whole life insurance explained

Danise, A. (2024, December 16). Is whole life insurance a good investment? Forbes Advisor. https://www.forbes.com/advisor/life-insurance/is-whole-life-insurance-a-good-investment/

ECONOMICS. (n.d.). Canada Stock Market Index (TSX) - 2023 Data - 1979-2022 Historical - 2024 Forecast. https://tradingeconomics.com/canada/stock-market

Hodges, D. Surprising truths about your RRSP. MoneySense. https://www.moneysense.ca/save/retirement/surprising-truths-about-your-rrsp/

Rothery, N. Why your returns are a lie. MoneySense. https://www.moneysense.ca/save/investing/stocks/why-your-stock-market-returns-are-a-lie/TRADING

What can you Expect your Whole Life Insurance Rate of Return to be? The Insurance Pro Blog. https://theinsuranceproblog.com/what-can-you-expect-your-whole-life-insurance-rate-of-return-to-be/

Jessica is a content marketing manager with PolicyMe. She has over a decade of experience creating content, including 10 years freelancing for nonprofits and small businesses in North America and beyond. She was previously the senior editor handling car insurance content for Silicon Valley startup, and the managing editor for creditcardGenius. She's passionate about breaking down complex financial topics into clear, approachable content that helps readers feel confident about their decisions.

Jessica is a content marketing manager with PolicyMe. She has over a decade of experience creating content, including 10 years freelancing for nonprofits and small businesses in North America and beyond. She was previously the senior editor handling car insurance content for Silicon Valley startup, and the managing editor for creditcardGenius. She's passionate about breaking down complex financial topics into clear, approachable content that helps readers feel confident about their decisions.